When businesses venture into international markets, the difference between triumph and costly failure often lies in the thoroughness of their preliminary research. Localization market research serves as the compass that guides companies through the complex terrain of cultural preferences, regulatory requirements, and competitive dynamics that define each target market. Organizations that invest adequately in understanding these factors before committing resources to localization consistently outperform those that rely on assumptions or surface-level analysis.

The stakes have never been higher for companies pursuing global expansion. Digital transformation has made international markets more accessible, but this accessibility has also intensified competition and raised customer expectations for locally relevant experiences. In this environment, market research for localization becomes not just advisable but essential for sustainable international growth.

TL;DR

|

The hidden costs of poor research

Every year, businesses lose millions due to poorly executed localization strategies that stem from insufficient preliminary research. These failures manifest in multiple ways: products that violate local regulations, marketing messages that offend cultural sensibilities, and user experiences that frustrate rather than delight international customers. The financial impact extends beyond direct losses to include opportunity costs, as companies must retreat from markets they could have successfully entered with proper localization market analysis.

Consider the cascading effects when international market research reveals critical insights too late in the process. A software company might discover after launch that their pricing model conflicts with local payment preferences, requiring extensive rework of their billing systems. An e-commerce platform could find that their checkout process violates data privacy regulations, necessitating urgent and expensive modifications. These scenarios illustrate why localization planning steps must begin with comprehensive research rather than treating investigation as an afterthought.

The true cost of inadequate research becomes apparent when examining customer acquisition and retention metrics across different markets. Companies that skip thorough cultural market insights gathering often see significantly lower conversion rates than those who invest in understanding local preferences. Support costs multiply when products aren’t properly adapted, with some organizations reporting substantially higher customer service expenses in poorly researched markets compared to well-understood ones.

A 4-pillar research framework for global success

Effective global localization strategy requires a structured approach to gathering and analyzing market intelligence. This framework should encompass multiple dimensions of market understanding, from macroeconomic indicators to micro-level consumer preferences. Successful companies typically organize their research around four key pillars: market viability assessment, competitive landscape analysis, cultural adaptation requirements, and operational feasibility evaluation.

| Pillar | What to evaluate | Methods and data sources | Key deliverables | How Lara Translate helps |

|---|---|---|---|---|

| Market viability | Digital access, payment norms, logistics, purchasing power, addressable segments, legal constraints | Government stats, industry reports, marketplace data, payment provider docs, expert interviews | TAM/SAM/SOM estimate, payment stack requirements, entry criteria, go or no-go gates | Rapid pilots for key assets across ≈55 file formats, styles for tone control, glossary-driven consistency |

| Competitive landscape | Direct and indirect competitors, price architecture, positioning, feature parity, gaps to win | Competitor teardown, pricing pages, app store reviews, SERP analysis, social listening | Differentiation map, price fences, value messages per segment, win-loss hypotheses | Maintain market-specific messaging via Translation Memories and glossaries; explain-choices notes for reviewers |

| Cultural adaptation | Visuals, color and symbolism, trust cues, copy tone, privacy expectations, local proofs and references | Interviews, focus groups, ethnography, analytics by locale, sentiment analysis of local channels | Style guide per market, voice and tone rules, trust element checklist, red-flag list to avoid | Document Styles (Fluid, Faithful, Creative), ambiguity flags, Learning Mode to adapt to local tone |

| Operational feasibility | Tech constraints, devices and bandwidth, release cadence, compliance, support readiness and SLAs | Tech audits, device mix data, legal review, support ticket analysis, pilot rollouts with KPI baselines | Localization runbook, risk register, KPI tree, rollout plan with checkpoints and owners | API and MCP integrations, Incognito Mode for strict privacy, role-based collaboration and review workflow |

Effective global localization strategy requires a structured approach to gathering and analyzing market intelligence. This framework should encompass multiple dimensions of market understanding, from macroeconomic indicators to micro-level consumer preferences. Successful companies typically organize their research around four key pillars: market viability assessment, competitive landscape analysis, cultural adaptation requirements, and operational feasibility evaluation.

Market viability assessment goes beyond simple demographic analysis to examine factors like digital infrastructure maturity, payment system prevalence, and logistics capabilities. Localization market research at this level reveals whether a market can support your business model or requires fundamental adaptations. For instance, markets with limited credit card penetration might necessitate alternative payment methods, while regions with unreliable internet connectivity could require offline-capable solutions.

Data-driven localization demands rigorous attention to methodology and source credibility. Primary research through surveys, interviews, and focus groups provides direct insights into consumer preferences and pain points. Secondary research leveraging government statistics, industry reports, and academic studies offers broader context and validation. The most successful localization ROI strategy implementations combine both approaches, using secondary research to identify promising markets and primary research to validate specific hypotheses about customer needs and preferences.

Methods to capture cultural insights (beyond language)

Culture influences every aspect of how customers interact with products and brands, from color preferences and imagery interpretation to communication styles and trust-building mechanisms. Local audience analysis must examine these factors systematically rather than relying on stereotypes or outdated generalizations. Modern cultural market insights gathering employs sophisticated techniques including ethnographic research, behavioral analytics, and sentiment analysis to understand how culture shapes consumer decisions.

Language represents just one dimension of cultural adaptation. Multilingual market research reveals that successful localization requires understanding how concepts and values translate across cultures, not just words. For example, privacy concerns vary dramatically between markets, with some cultures prioritizing data protection while others value personalization even at the cost of privacy. These insights inform everything from product feature prioritization to marketing message development.

Trust impact: 75% of consumers will not purchase from companies they don’t trust with their data. Align privacy messaging and consent UX to local norms. [Source]

The importance of market validation for localization becomes clear when examining failed market entries. Products that succeed in one culture can fail spectacularly in another if cultural factors aren’t properly considered. A mobile app’s gesture-based interface might work perfectly in markets where smartphone usage is mature but confuse users in regions where touch interfaces are still novel. These failures underscore why localization best practices emphasize deep cultural understanding over surface-level translation.

Implementing research with Lara Translate (glossaries, TMs, APIs)

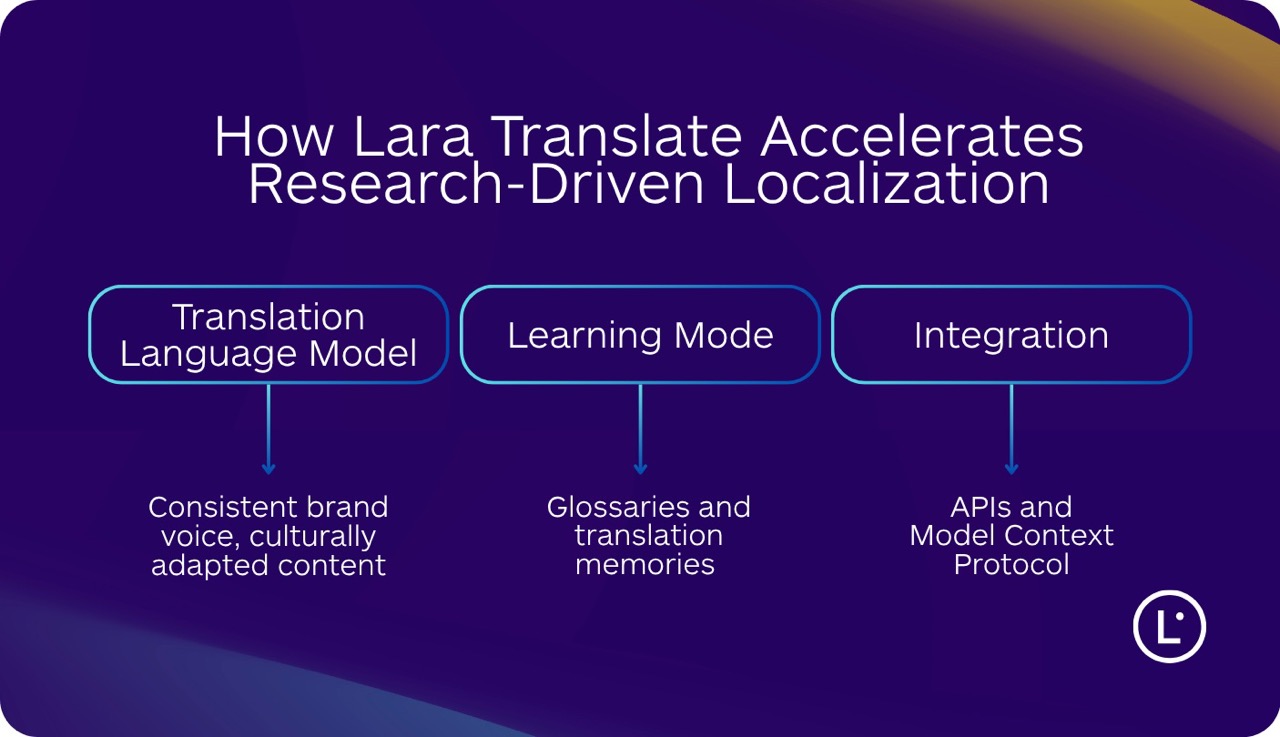

Modern localization tools must bridge the gap between research insights and practical implementation. Lara Translate addresses this challenge through its specialized Translation Language Model, purpose-built for professional translation rather than general language processing. Unlike broad AI systems that struggle with consistency and terminology management, Lara Translate maintains coherent brand voice across all markets while allowing for culturally appropriate adaptations. The platform supports a growing list of languages, and you can check the updated list of supported languages in the documentation.

The platform’s Learning Mode enables organizations to incorporate language market potential insights directly into the translation process. When research identifies specific terminology preferences or communication styles for different markets, these can be codified in glossaries and translation memories that help maintain consistency across all content. This systematic approach to implementing research findings distinguishes Lara Translate from generic translation tools that lack the sophistication to maintain nuanced market-specific adaptations.

Integration capabilities further enhance Lara Translate‘s value for research-driven localization strategies. Through APIs and the Model Context Protocol, the platform connects seamlessly with content management systems, development environments, and analytics tools. This technical infrastructure enables rapid iteration based on market feedback, supporting the continuous improvement cycle that successful global go-to-market strategy requires.

Localization risk management: compliance, competition, ops

Localization risk management begins with identifying and prioritizing potential failure points before they materialize. Comprehensive market research before localization examines regulatory compliance requirements, intellectual property considerations, and competitive dynamics that could derail market entry. This proactive approach to risk identification allows companies to develop mitigation strategies before committing significant resources.

Regulatory compliance represents one of the most critical risk factors in international expansion. International market research must examine not just current regulations but also pending legislative changes that could affect your business model. Data privacy laws, content restrictions, and industry-specific regulations vary dramatically between markets. For instance, healthcare applications face stringent requirements in some markets while operating with minimal oversight in others. Understanding these differences through research helps reduce costly compliance failures that could result in fines, legal action, or forced market exit.

Signal: 53% of consumers say they’re aware of privacy laws, raising expectations that brands comply and communicate clearly. [Source]

Competitive risk assessment requires understanding both direct competitors and alternative solutions that meet similar customer needs. Localization market research should examine how established players have positioned themselves, what market gaps exist, and whether your differentiation translates effectively to the new market. This analysis often reveals that competitive advantages in one market become table stakes in another, necessitating strategy adjustments to maintain differentiation.

Technical infrastructure and operational capabilities constitute another critical risk dimension. Localization planning steps must evaluate whether target markets have the technical prerequisites for your product or service. This includes internet penetration rates, device types in common use, and technical literacy levels. Markets might require significant product modifications to accommodate local technical constraints, from reducing bandwidth requirements to supporting older device models still prevalent in certain regions.

Choosing languages and markets by revenue potential

Language selection strategy represents one of the most consequential decisions in localization, yet many organizations still base this choice primarily on speaker populations. Sophisticated aligning localization with revenue requires analyzing multiple factors including purchasing power, market maturity, competitive intensity, and growth trajectories. A language spoken by hundreds of millions might offer less revenue potential than one serving a smaller but more affluent audience with fewer established competitors.

Connecting market insights to language strategy involves mapping the customer journey to identify where translation provides maximum value. B2B software companies might find that localizing sales and onboarding materials generates better returns than translating the entire product interface. E-commerce platforms could discover that adapting product descriptions and checkout flows drives more revenue than localizing blog content. This targeted approach ensures resources focus on high-impact areas identified through business case for localization analysis.

Digital behavior patterns reveal surprising insights about language preferences across different transaction types. International audience targeting research consistently shows that while many professionals work comfortably in English, they strongly prefer conducting financial transactions, reviewing legal terms, and making purchase decisions in their native language. These behavioral nuances inform localization investment planning and help prioritize which content types require immediate translation versus those that can be addressed in later phases.

Implementing scalable localization with Lara Translate

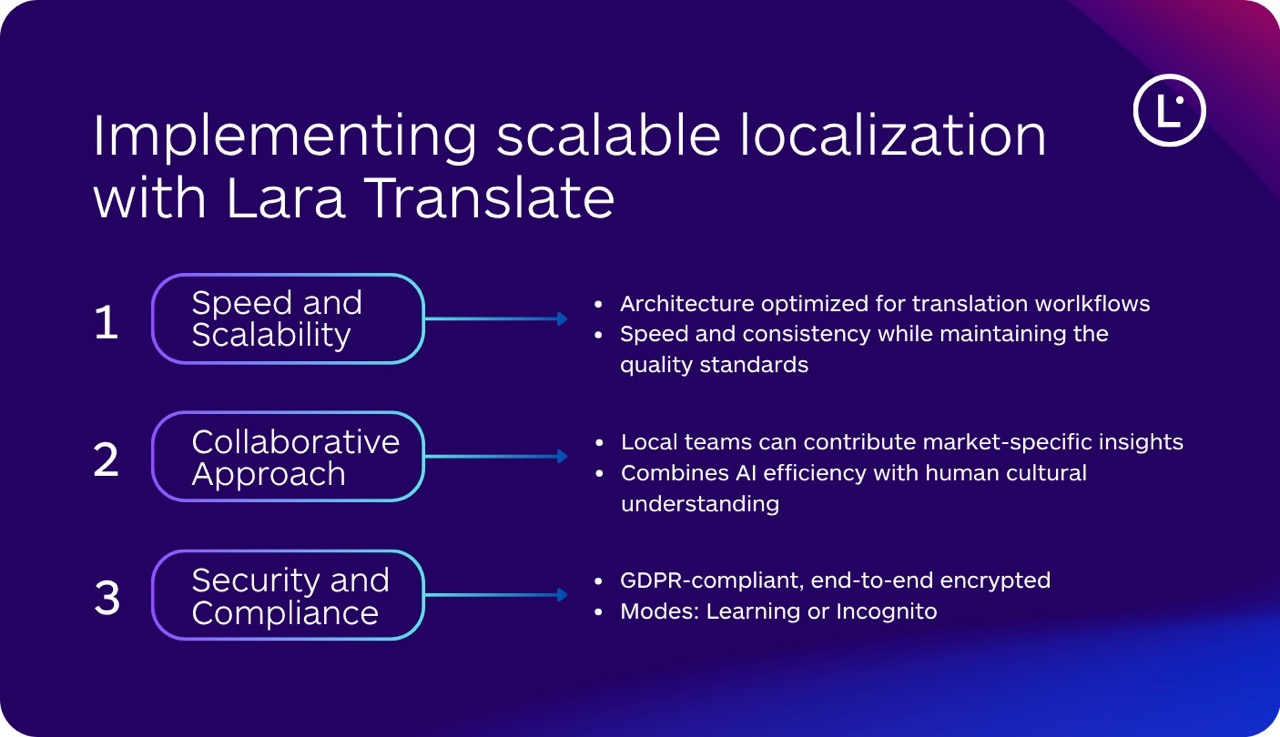

Once research identifies promising markets and languages, implementation speed becomes crucial for capitalizing on opportunities before competitors. Lara Translate accelerates this process through its architecture optimized specifically for translation workflows rather than general language tasks. The platform processes content with the speed and consistency required for large-scale localization projects while maintaining the quality standards that brand reputation demands.

The platform’s team collaboration features enable distributed organizations to incorporate regional expertise directly into the localization process. Local teams can contribute market-specific insights through glossaries and translation memories, helping to deliver translations that resonate authentically with target audiences while maintaining brand consistency. This collaborative approach combines AI efficiency with human cultural understanding.

Security and compliance capabilities within Lara Translate address the data protection requirements identified through localization market analysis. With GDPR-compliant data handling, end-to-end encryption, and flexible deployment options, the platform meets the stringent security requirements of regulated industries. Organizations can choose between Learning Mode for continuous improvement or Incognito Mode for maximum privacy, adapting to different market requirements and regulatory constraints identified through research.

Metrics: how to measure and optimize localization ROI

Localization success metrics extend beyond simple translation accuracy to encompass business impact measures including market penetration rates, customer satisfaction scores, and revenue per user across different regions. Establishing these KPIs before market entry enables objective assessment of whether localization investments deliver expected returns. Organizations using comprehensive evaluating cultural fit for localization frameworks report being able to identify and address performance issues significantly faster than those relying on ad-hoc measurement.

Practical baseline: Use checkout UX lift (~35%) and wallet adoption share (≈50%) as directional ceilings when sizing conversion headroom by market. [Sources]

Performance data reveals patterns that inform future localization decision-making. Companies often discover unexpected correlations between specific localization elements and business outcomes. For instance, adapting date and time formats might seem trivial but could significantly impact conversion rates in markets where unfamiliar formats create confusion or distrust. These insights feed back into the research process, creating a continuous improvement cycle that strengthens competitive advantage over time.

The feedback loop between market performance and localization strategy requires robust analytics infrastructure. Cross-border marketing research should establish baseline metrics before localization, then track changes as adaptations are implemented. This systematic approach to measurement enables data-driven decisions about where to invest additional localization resources and which markets warrant deeper adaptation versus lighter-touch approaches.

Advanced analytics techniques including cohort analysis, attribution modeling, and predictive analytics help organizations understand the long-term value of localization investments. Emerging markets localization often requires patience, with full returns materializing over multiple years as brand awareness builds and customer trust develops. Research-driven organizations use these insights to set realistic expectations and maintain investment discipline even when immediate returns fall short of projections.

Building sustainable competitive advantage through research

Long-term success in international markets requires treating localization market research as an ongoing discipline rather than a one-time exercise. Markets evolve continuously, with changing consumer preferences, new competitive entrants, and shifting regulatory landscapes. Companies that maintain active research programs can anticipate and adapt to these changes, while those that rely on outdated insights risk losing relevance.

The importance of market research in localization grows as artificial intelligence transforms the translation landscape. While AI tools reduce the tactical burden of translation, they amplify the importance of strategic decisions about where, when, and how deeply to localize. Organizations that combine robust research capabilities with modern translation technology like Lara Translate can enter more markets with greater confidence, knowing their localization investments align with genuine market opportunities.

Building internal research capabilities ensures organizations can respond quickly to new opportunities without depending entirely on external consultants. This includes developing relationships with local partners who provide ground-level insights, establishing systematic feedback collection mechanisms, and creating processes for rapid hypothesis testing. Companies with mature how to choose languages for localization processes report being able to evaluate and enter new markets significantly faster than those starting fresh with each expansion.

The compound effect of systematic research becomes apparent over time. Each market entry generates insights that inform future expansions, creating a knowledge base that accelerates subsequent localization efforts. This accumulated understanding of how to research target markets becomes a sustainable competitive advantage, enabling experienced organizations to identify and capture opportunities that less sophisticated competitors miss.

FAQs

What’s the minimum viable research needed before entering a new market?

Essential localization market analysis should include regulatory compliance review, competitive landscape assessment, basic cultural adaptation requirements, and payment infrastructure evaluation. This foundational research can be completed in 6-8 weeks for a single market.

How can Lara Translate support research-driven localization strategies?

Lara Translate provides the technical infrastructure to quickly implement research findings through customizable glossaries, translation memories, and workflow integrations. Its specialized translation model ensures consistency while allowing for market-specific adaptations identified through research.

Which markets typically require the deepest localization efforts?

Markets with distinct cultural values, unique regulatory requirements, or strong local competition generally require deeper adaptation. International market research helps identify these markets early, allowing for appropriate resource allocation and timeline planning.

How do you measure the ROI of localization market research?

Calculate ROI by comparing market entry success rates, time-to-profitability, and customer acquisition costs between researched and non-researched markets. Companies using systematic localization research framework typically see substantially better performance metrics across these dimensions.

This article is about

- Strategic frameworks for conducting localization market research that identifies genuine revenue opportunities and minimizes expansion risks

- Practical methodologies for de-risking localization projects through systematic validation of market assumptions and cultural fit assessment

- How Lara Translate enables rapid implementation of research insights through specialized translation technology and collaborative workflows

- Data-driven approaches to aligning localization with revenue potential across different markets and customer segments

- Building sustainable global localization strategy through continuous research and performance optimization

Have a valuable tool, resource, or insight that could enhance one of our articles? Submit your suggestion

Have a valuable tool, resource, or insight that could enhance one of our articles? Submit your suggestion