If you’re planning to expand your business internationally, one question keeps coming up: which languages to translate first? The wrong choice can waste resources and delay your entry into profitable markets. The right one can speed up expansion and may help maximize the return on investment.

The t-index is a data-driven metric designed to answer exactly this question. It ranks languages by their online purchasing power, helping businesses identify which markets offer the strongest revenue potential before committing translation budgets. Rather than relying on gut feeling or simply targeting the languages with the most native speakers, the t-index provides an evidence-based framework that considers actual e-commerce behavior and digital market size.

Understanding how to use the t-index alongside other strategic factors gives you a competitive edge when entering new markets. This guide walks through what the t-index measures, how to interpret it for your business context, and how to build a complete language prioritization strategy that balances market potential with practical execution. If you’re looking for broader guidance on international growth, check out our comprehensive guide on how to expand your business with translations.

What is the t-index?

The t-index (Translation Index) is a ranking system that measures the relative value of translating content into different languages based on their online sales potential by language. Created to help businesses prioritize localization investments, it aggregates multiple data points including internet penetration rates, e-commerce adoption, GDP, and the number of online consumers who speak each language.

The metric emerged from a straightforward business need: companies needed an objective way to compare markets when planning international expansion. While population size provides one data point, it doesn’t account for digital readiness, disposable income, or cultural willingness to purchase online. The t-index synthesizes these factors into a single comparable number.

For example, according to the t-index framework, languages like English, Mandarin Chinese, and Spanish rank at the top due to their combination of large speaker populations and high digital commerce activity. However, languages like Japanese or German may rank higher than you’d expect based purely on speaker numbers, because their markets show exceptional purchasing power per capita.

The practical value becomes clear when you consider that translating into a language spoken by 100 million people with low internet adoption and limited e-commerce infrastructure will deliver far less revenue than targeting 50 million digitally active consumers with established online shopping habits. The t-index helps you spot these disparities before you invest.

How to identify the best languages for website translation

Choosing the best languages for website translation requires more than checking a ranking list. The t-index provides valuable directional guidance, but your specific market selection should layer in additional strategic considerations that reflect your business model, product category, and competitive landscape.

Start with your data

Before consulting any external metrics, examine your own analytics. If you’re already receiving organic traffic from specific countries or language groups, that’s real-world validation of demand. Look at your Google Analytics or similar platform to identify which countries generate the most visits to your site, where you see the highest conversion rates, which languages your customer support team fields inquiries in, and geographic patterns in your email signups or product interest.

This existing signal often reveals markets you hadn’t consciously targeted. A surge of visitors from Brazil, consistent inquiries in German, or unexpected purchases from Japan all indicate organic demand worth investigating further.

Consider market fundamentals beyond the t-index

While the t-index focuses on online sales potential by language, effective market selection requires evaluating additional dimensions.

Economic viability matters. Look beyond current GDP to growth trajectories. Markets like India, Indonesia, or Vietnam may show explosive growth rates that make them strategic choices for early entry, even if their absolute purchasing power today sits lower than mature markets. The question isn’t just “how big is this market now?” but “how big will it be in three to five years?”

Digital infrastructure also varies dramatically. E-commerce penetration and payment system maturity differ across markets. High smartphone adoption, established logistics networks, and popular local payment methods (like PIX in Brazil or UPI in India) reduce friction and accelerate your path to revenue. Cross-border ecommerce is concentrated in a handful of large, digitally mature markets. If cross-border is central to your model, validate flows with a recent market report before finalizing language picks (souce: Avalara).

Competitive intensity should factor into your decision. Entering a market where established players already dominate requires different resources than being among the first movers. Tools like Similarweb or SEMrush can reveal which competitors have already localized for specific languages and how much traffic they’re capturing.

Prioritize based on strategic tiers

Once you’ve gathered data from the t-index, your own analytics, and market fundamentals, organize target languages into strategic tiers.

Tier 1 represents immediate priority languages where you have the strongest business case combining multiple factors. These typically show validated existing demand, strong t-index ranking, accessible market entry, and alignment with your product’s value proposition. Most businesses start with 2-4 Tier 1 languages that offer the highest probability of rapid ROI.

Tier 2 includes medium-term expansion markets with strong fundamentals but requiring more preparation or investment. This might include languages where the t-index ranking is high but you lack existing demand signals, or where cultural adaptation needs are more substantial.

Tier 3 covers long-term strategic languages that don’t show immediate commercial promise but have strategic value. This could include markets where regulatory changes are expected, where your competitors aren’t active yet, or where early presence builds brand equity for future growth.

This tiered approach prevents the common mistake of trying to localize into too many languages simultaneously, which typically results in poor quality across all markets rather than excellence in your top priorities.

Practical framework: which languages to translate first

Moving from analysis to action requires a structured decision framework. Here’s how to synthesize the t-index data with your business context into concrete language choices.

Apply the 80/20 rule

For most businesses, a small number of languages will drive the majority of international revenue. Rather than attempting to cover dozens of markets thinly, concentrate resources on the languages that collectively represent 70-80% of your addressable market opportunity.

If you’re in e-commerce, this typically means starting with English (if it’s not your source language), followed by combinations like Spanish, French, German, and Mandarin Chinese depending on your product category. The global e-commerce market share data shows these languages consistently deliver strong returns due to high digital adoption and purchasing power.

SaaS companies often prioritize differently, perhaps leading with German and Japanese due to high enterprise software spending in those markets. The specific combination depends on where your product finds the strongest product-market fit, but the principle remains: depth matters more than breadth in early international expansion.

Account for language variants and regional differences

Major languages aren’t monolithic. Spanish alone fragments into European Spanish, Mexican Spanish, and other Latin American variants with meaningful differences in vocabulary and cultural references. Similarly, Portuguese splits between Brazilian Portuguese and European Portuguese, while French varies significantly between France, Canada, and African markets.

Your approach to variants should reflect market priorities and resource constraints. Start with the dominant variant if budget is limited (Mexican Spanish reaches more digital consumers than European Spanish), create separate variants when markets differ substantially in purchasing behavior, and use neutral language when possible for technical documentation.

Industry-specific considerations

Different sectors find success in different markets based on unique dynamics that complement t-index rankings.

E-commerce and retail should focus heavily on markets with established online shopping habits and efficient logistics. Japanese consumers show exceptionally high online spending per capita despite a smaller population. Korean and German markets also demonstrate strong digital commerce adoption.

B2B and SaaS businesses see different patterns. Enterprise software adoption doesn’t always correlate with consumer behavior. German and Japanese businesses show high willingness to invest in business tools. Nordic countries punch above their weight in software spending. French enterprises prefer localized solutions and often require French-language content for procurement processes.

Content and media companies find that English dominates but secondary languages vary by content type. Spanish reaches massive audiences across Latin America and the United States. Portuguese (Brazilian) opens up the largest single market in Latin America. Arabic provides access to high-engagement audiences across the Middle East and North Africa.

Industry-specific considerations with real examples

Different sectors find success in different markets based on unique dynamics that complement t-index rankings. Here’s how leading companies have applied language prioritization strategies in practice:

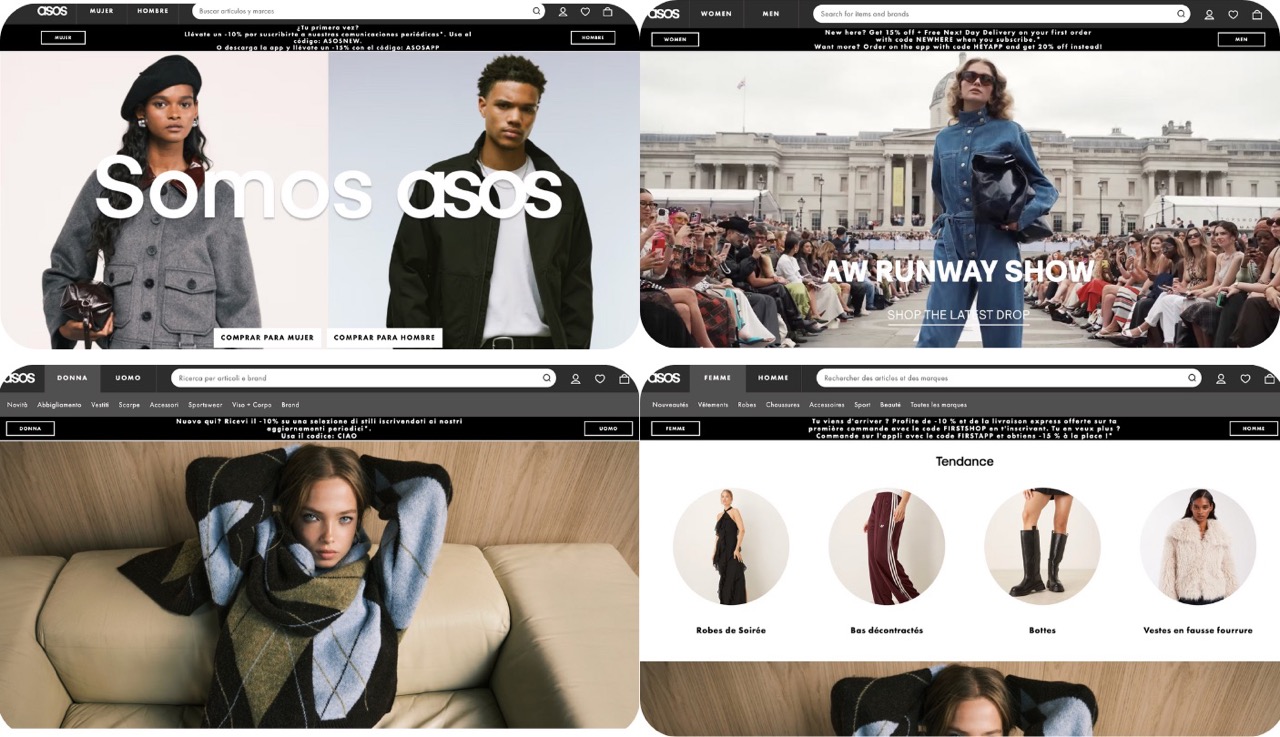

E-commerce and retail success stories: British fashion retailer ASOS demonstrates the power of strategic language prioritization. The company increased international sales from less than 30% to over 60% in just three years by launching localized websites for key markets including the United States, Germany, France, Italy, Australia, Spain, and Russia. This concentrated approach to the best languages for website translation allowed ASOS to double its overall sales while establishing strong positions in markets ranked highly by the t-index. The company’s success came from offering fully localized buying experiences – translating not just product descriptions but adapting the entire customer journey including checkout, payment methods, and shipping options for each target market.

Technology and consumer electronics: the Japanese market illustrates how cultural localization drives market share even in highly competitive sectors. Apple frequently leads Japan’s smartphone market, often near or above 50% share depending on the period reported. This dominance stems partly from Apple’s approach to Japanese localization – the company carefully adapts marketing messages to resonate with local audiences while maintaining brand consistency. For example, their iPhone campaigns use Japanese copywriting that retains the emotional impact of English originals while feeling natural to Japanese consumers. The Japanese market’s high online sales potential by language and sophisticated digital infrastructure make it a Tier 1 priority despite its relatively smaller population compared to other Asian markets.

B2B and SaaS patterns: Enterprise software companies often find that the best languages for website translation differ from consumer markets. German businesses show exceptionally high willingness to invest in business tools and expect clear, precise content with straightforward messaging. Japanese B2B buyers follow methodical, extended evaluation processes and prefer high-context communication with thorough descriptions. French enterprises frequently require French-language content for procurement processes, making French localization essential despite the market’s smaller size compared to English-speaking markets. These cultural differences in business communication styles mean that which languages to translate first for B2B companies requires analyzing not just market size but decision-making processes and communication preferences.

These examples demonstrate that successful language expansion requires more than translation – it demands deep understanding of local purchasing behaviors, cultural expectations, and market-specific preferences that the t-index helps identify but companies must then execute thoughtfully.

How Lara Translate accelerates strategic language expansion

When you’ve identified your priority languages based on the t-index and strategic fit, efficient execution becomes paramount. Lara Translate offers a specialized approach to business translation that addresses the core challenges companies face when expanding into new language markets.

Purpose-built for business translation

Lara Translate is specifically designed as a Translation Language Model (T-LM), trained on professionally reviewed business documents and technical content. Unlike general-purpose AI language models that treat translation as one capability among many, Lara Translate focuses exclusively on delivering contextually accurate, domain-specific translations for professional use.

This specialization matters when you’re executing the language strategy you’ve built using t-index insights. The platform currently supports 31 of the world’s most widely spoken languages, and aims to cover over 200 languages in the near future. This coverage aligns well with t-index priorities, ensuring that whether you’re targeting top-ranking languages like English, Mandarin, or Spanish, or expanding into high-growth markets like Vietnamese or Indonesian, the platform supports your strategy. For a complete list of supported languages and combinations, visit our language support guide.

Speed and efficiency for market entry

When you’re entering multiple language markets based on t-index rankings, translation speed determines your time-to-market. Lara Translate processes translations significantly faster than traditional workflows and leading large language models (LLMs) — approximately 20 times faster for standard documents — with 99% of translations completing in under 1.2 seconds. This speed allows you to localize substantial content libraries quickly, reducing the lag between market identification and market entry.

The platform’s cost efficiency matters particularly for non-English workflows. Many businesses outside the United States don’t operate primarily in English but still need to reach English-speaking markets. Lara Translate optimizes for these scenarios by reducing the token costs associated with processing non-English text, making bilateral translation strategies more economically viable.

Quality for high-value markets

Markets ranked highly on the t-index represent significant revenue opportunity, which means translation quality directly impacts your revenue capture. Lara Translate’s training on professionally reviewed business documents helps maintain semantic accuracy and appropriate tone across languages. For business contexts where mistranslation can damage credibility or cause customer confusion, this domain-specific training provides a quality advantage.

The platform offers Learning Mode and Incognito Mode options, giving you control over whether your translations contribute to model improvement or remain private. This flexibility allows you to use AI translation speed for sensitive content while maintaining confidentiality – important when translating strategic documents for high-value markets. Learn more about choosing between Learning and Incognito modes based on your privacy requirements.

Scalable workflow infrastructure

Successfully expanding into languages prioritized through t-index analysis requires workflow infrastructure that can handle both initial localization and ongoing content updates. Lara Translate’s API integration allows you to build automated localization pipelines that translate new content as you publish it, ensuring that all language markets stay current without manual intervention.

The Lara Translate Agent automates tasks like project setup and file preparation, reducing the operational overhead of managing multiple language versions. For workflows that combine AI translation with human post-editing, Lara Translate supports integration with Computer-Assisted Translation tools like Matecat, letting professional translators review and refine AI output when human expertise is required for culturally nuanced content.

Through support for the Model Context Protocol (MCP), Lara Translate can work alongside other AI agents in your workflow, coordinating translation with content generation, SEO optimization, and other localization tasks. This integration capability means you can use Lara Translate as the translation engine within a comprehensive localization strategy.

When to combine AI with human expertise

While Lara Translate dramatically increases efficiency, the role of human translators remains important for certain aspects of market expansion into high-t-index markets. Cultural adaptation for brand messaging requires more than linguistic accuracy. Human translators understand cultural references, humor, and sensitivities that can make the difference between a message that resonates and one that falls flat.

Regulatory and legal content in markets with high purchasing power often have sophisticated regulatory environments. Terms of service, privacy policies, and product safety information require verification by human experts who understand both the language and the legal framework of the target market. Understanding the legal and ethical considerations of AI translation helps you navigate when human oversight becomes essential.

The optimal approach for most businesses expanding based on t-index priorities combines AI translation for speed and scale with human expertise for cultural adaptation, legal verification, and domain-specific quality assurance. This hybrid model delivers both the efficiency necessary to enter multiple markets quickly and the quality required to succeed once you’re there. If you’re new to using Lara Translate, our beginner’s guide walks you through getting started with this hybrid approach.

Building your language expansion roadmap

With your priority languages identified through t-index analysis and market research, successful execution requires a structured rollout plan that builds momentum without overwhelming your team or budget.

Phase 1: Foundation in top-tier markets

Begin with 2-3 languages that show the strongest combination of t-index ranking, existing demand signals from your analytics, and alignment with your business model. These foundation languages should receive your full localization effort, including complete content coverage, market-specific SEO, payment and logistics infrastructure, and performance measurement systems.

This concentrated effort in foundation markets builds credibility, captures revenue quickly, and generates learnings that inform expansion into subsequent language tiers.

Phase 2: Expanding to growth markets

Once your foundation languages stabilize and you’ve refined your localization processes, expand to your second tier of 3-5 additional languages. These typically include high-growth markets where the t-index indicates strong potential but where you had less existing demand validation.

Leverage learnings from Phase 1 to accelerate rollout. Apply insights about which content types drive the most engagement, what localization mistakes to avoid, and which aspects of your product documentation required the most revision.

Phase 3: Long-term strategic markets

Languages in your third tier represent either smaller markets, more challenging regulatory environments, or longer-term strategic positioning. Approach these selectively based on competitive dynamics and available resources, maintaining awareness without actively investing until circumstances improve their risk-reward profile.

Measuring success and optimizing your strategy

The decision about which languages to translate first requires ongoing validation through clear measurement and willingness to adjust strategy based on results.

Track revenue metrics separately for each language market, including total revenue by language, revenue per visitor, average order value, and customer lifetime value. These metrics directly validate whether markets identified as high-potential through t-index analysis actually deliver commercial results.

Monitor engagement metrics like organic traffic volume, bounce rate, time on site, and return visitor rate by language. High traffic with poor engagement often indicates translation quality issues, cultural misalignment, or product-market fit problems that need addressing.

Analyze conversion funnel metrics to identify where localization weaknesses cause revenue leakage. Perhaps payment options don’t match market preferences, or translated product descriptions leave questions unanswered that prevent purchase decisions.

Compare actual performance against your initial projections based on t-index data. Results above or below these projections inform whether your market selection methodology needs refinement or whether execution issues are limiting results. Performance data should drive resource allocation decisions: double down on markets showing strong traction, pivot on markets with moderate results and identifiable issues, and exit markets consistently underperforming despite optimization efforts.

Turning insights into action

The t-index provides valuable guidance for initial market selection by quantifying online sales potential by language, but successful international expansion requires combining this data with strategic analysis, efficient execution, and ongoing optimization. By identifying the best languages for website translation based on multiple factors, implementing efficient translation workflows with tools like Lara Translate, and continuously measuring performance, you can turn language strategy into sustained revenue growth across global markets.

FAQs

What is the t-index and how does it help prioritize languages?

The t-index (Translation Index) ranks languages by their online purchasing power, combining factors like internet penetration, e-commerce adoption, GDP, and number of online consumers. It helps businesses identify which languages offer the strongest revenue potential before committing translation budgets, moving beyond simple population counts to focus on actual digital commerce behavior and market size.

Which languages to translate first for e-commerce businesses?

For e-commerce, start with languages showing high online sales potential by language: typically English (if not your source language), followed by Spanish, German, French, and Mandarin Chinese depending on your product category. However, check your own analytics first – existing traffic and conversions from specific markets provide the strongest validation. The t-index ranks Japanese and Korean highly due to exceptional per-capita online spending.

How many languages should I translate my website into initially?

Begin with 2-4 Tier 1 languages that show the strongest combination of t-index ranking, existing demand in your analytics, and strategic fit with your business model. Depth matters more than breadth in early expansion – complete localization of fewer languages outperforms partial coverage of many languages. Apply the 80/20 rule: a small number of carefully chosen languages typically drives 70-80% of international revenue potential.

Does the t-index account for language variants like Mexican vs. European Spanish?

The t-index typically ranks languages at a high level, but your execution must account for regional variants. Spanish fragments into European Spanish, Mexican Spanish, and other Latin American variants with meaningful vocabulary and cultural differences. Start with the dominant variant that reaches more digital consumers (Mexican Spanish has broader reach than European Spanish), then create separate variants as specific markets prove their revenue potential.

How does Lara Translate support businesses expanding into t-index priority markets?

Lara Translate is a specialized Translation Language Model trained on professional business content, supporting 31 languages (and aiming to cover over 200 languages soon). It processes translations approximately 20 times faster than leading large language models (LLMs), with 99% completed in under 1.2 seconds, enabling rapid market entry. The platform offers API integration for automated workflows, team collaboration features, Learning and Incognito modes for security, and integration with CAT tools for hybrid AI-human workflows – addressing the core challenges of scaling into multiple high-potential language markets identified through t-index analysis.

This article is about

- The t-index metric that ranks languages by online purchasing power to help businesses identify which markets offer the strongest revenue potential for translation investment

- Strategic framework for determining the best languages for website translation based on t-index data, analytics, market fundamentals, competitive intensity, and industry-specific patterns

- Practical guidance on which languages to translate first, including tiered prioritization (Tier 1, 2, 3), the 80/20 rule for focusing resources, and accounting for regional language variants

- How online sales potential by language varies across markets based on e-commerce maturity, digital infrastructure, payment preferences, and cultural purchasing behaviors beyond simple population metrics

- Leveraging Lara Translate for efficient language expansion with specialized Translation Language Model capabilities, speed advantages, workflow automation, and integration options that support data-driven international growth strategies

Have a valuable tool, resource, or insight that could enhance one of our articles? Submit your suggestion